How much can i borrow mortgage salary

Business Find out how we can help your business. You can use the above calculator to estimate how much you can borrow based on your salary.

How Much Mortgage Can I Afford With My Income

31000 23000 subsidized 7000 unsubsidized Independent.

. If youre hoping to take out a mortgage our borrowing calculator will give you a rough idea of how much a lender might offer you based on how much you earn and whether youre buying with anyone else. Add this amount to your deposit and youll find the budget for your new home. This assumes that you dont have any existing debts and a clear credit rating.

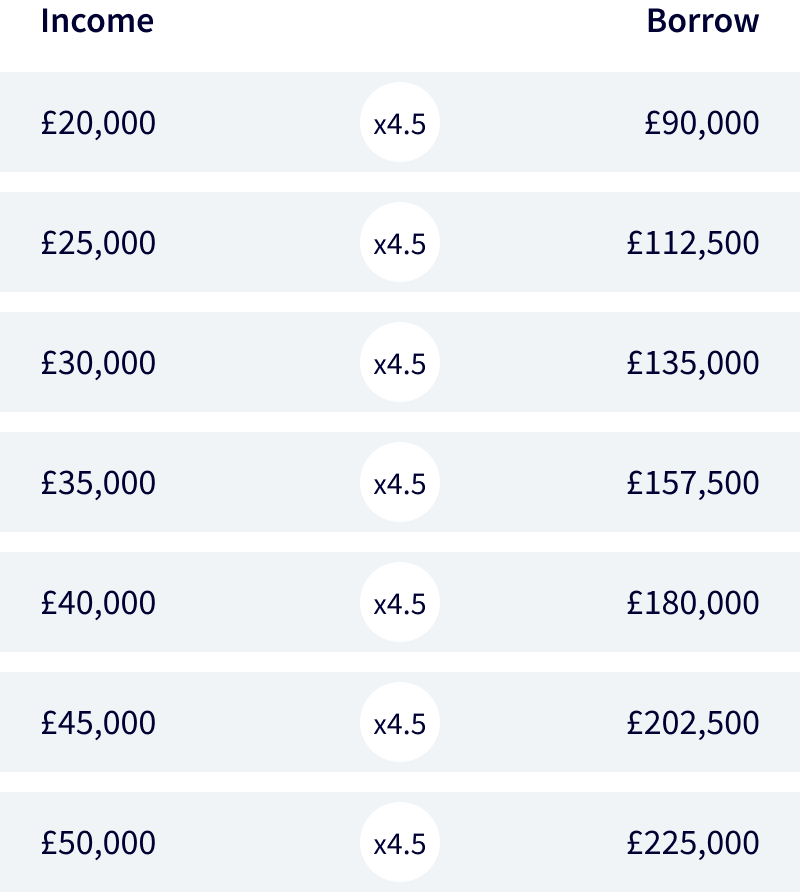

Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. When all things are considered like your debt down payment and mortgage rate you might find you could borrow as much as 6 or 7 times your salary for a mortgage.

When arranging mortgages we need to satisfy lenders that can comfortably afford the repayments on the mortgage. Some lenders offer up to 6 times your salary but they will be very strict about who they lend this amount to. Our mortgage calculator can give you a good indication of the amount you.

Mortgage rates are determined by your lender and can be fixed or adjustable. Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that the property is likely to generate. This is rather very unlikely.

How much can I borrow. How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you. Second time buyers can take out a mortgage of up to 80.

You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call. We compare how much the biggest supermarkets charge for a trolley of groceries including everything from bread to toothpaste and you might be amazed by how much the differences can be. Lenders will typically need the rental income to be at least 125 of the monthly mortgage payments on an interest only basis or even up to.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Lets presume you and your spouse have a combined total annual salary of 102200. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

Or 4 times your joint income if youre applying for a mortgage. Can I borrow a mortgage that is worth five times my salary. When it comes to calculating affordability your income debts and down payment are primary factors.

Stable and reliable generally includes sources such as your salary spouses salary pensionretirement part-time income and bonuses if they are reliable and anticipated to continue. Find out what you can borrow. You can usually borrow around 4 to 5 times your salary.

A combined salary of 100000 could be eligible to borrow 400000. Along with the down payment this is probably one of the two biggest factors that determine how much you can afford. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. All the news you need. This mortgage calculator will show how much you can afford.

Factors that impact affordability. All the news you need. How much does a mortgage broker cost.

Speak to a mortgage broker to find out how your situation could affect how much mortgage you can borrow. PMI typically costs between 05 to 1 of the entire loan amount. What mortgage can I get for 500 a month in the UK.

How much can I borrow. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Products services Accounts borrowing online banking and merchant services Business Specialists Find the specialist who best understands your kind of.

Your salary will have a big impact on the amount you can borrow for a mortgage. First time buyers can take out a mortgage of up to 90 of the purchase price of a home. Find out how much you can borrow.

Your lender typically requires two years of W2s and current pay stubs to verify income. If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years. The amount of a mortgage you can afford based on your salary often comes down to. Private mortgage insurance PMI is required for borrowers of conventional loans with a down payment of less than 20.

The brokers commission which is usually paid by the lender varies but it typically. How to borrow from home equity. This means they can stay the same or change over the life of the loan.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Mortgage advisers available 7 days a week. If youd prefer to wait until were open again call 0808 189 2301 between 9am and 6pm Mon - Fri.

For example in January 2022 shoppers would have paid a huge 37 more at Waitrose the priciest supermarket compared with Lidl which was cheapest. Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. While your personal savings goals or spending habits can impact your.

Or your budget could be smaller. Mortgage rate refers to the interest rate on your mortgage. Ultimately your maximum mortgage eligibility is calculated by weighing your.

Usually banks and. Total subsidized and unsubsidized loan limits over the course of your entire education include. Home buying with a 70K salary.

Mortgage Calculator Salary Deals 60 Off Www Ingeniovirtual Com

20 Personal Finance Charts To Help You Build Wealth In 2022 Banker On Fire

12 Step Guide To Getting Your Finances In Order Learn To Negotiate Salary Bills And Everything Else Personal Finance Books Money Advice Finance

How Student Debt Makes Buying A Home Harder And What You Can Do About It Student Loan Payment Mortgage Approval Student Loan Debt

Adviser Checklist How To Search For A Financial Adviser Financial Advisors Advisor Financial

Need A Personal Loan Loans For Poor Credit Personal Loans Loans For Bad Credit

Are You Broke Even Before The Month End Worry Not Apply For Chotaloan With Rupeeredee Get Instant Cash Within 5 Personal Loans How To Apply Instant Cash

A Home Of Your Own Living Room Theaters Home Buying Living Room Bench

Can You Get A Mortgage With A Part Time Job Uk Nuts About Money

Money Girl Philippines 3 Rules For Lending Money To Friends And Family Family Money Money Lending Borrow Money

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

The Evolution Of Financing Small Business Finance Business Finance Finance

How Much Personal Loan Can I Get On My Salary Personal Loans Loan Apply For A Loan

How I Got A Credit Score Over 800 And You Can Too Future Expat Credit Repair Business Credit Repair Check Credit Score

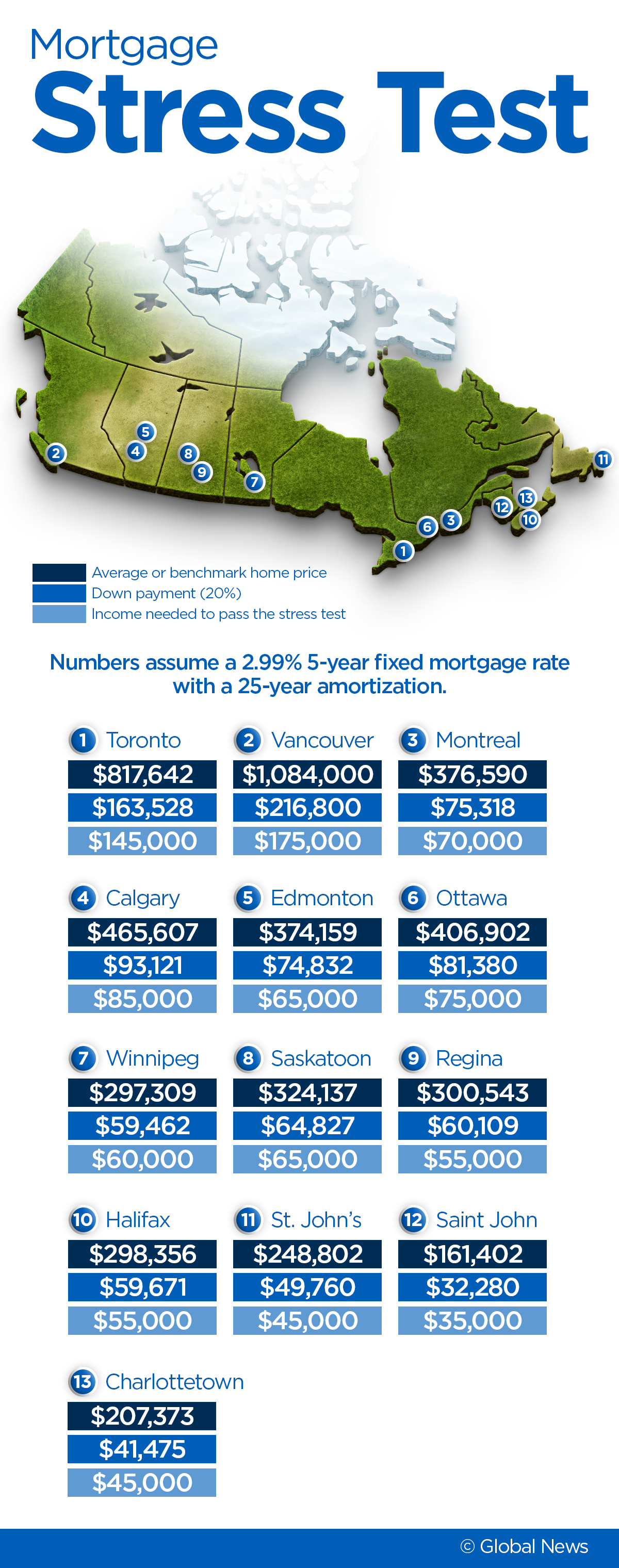

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth